“HSBC SUED BY THE TRUSTEE FOR SENDING CASH TO  MADOFF” >

MADOFF” >

FROM THE -

JOURNALS of Monte Friesner ~ Monday December 06, 2010 >

Financial Crime Consultant for WANTED SA >

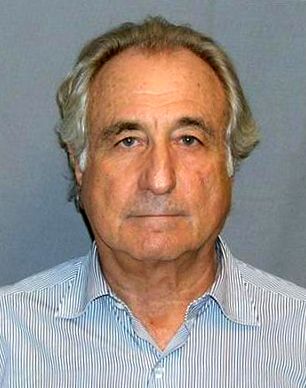

WANTED SA has learned this evening of Sunday that the trustee seeking assets for victims of Bernard L. Madoff’s global Ponzi scheme filed a lawsuit on Sunday seeking $9 billion from a roster of defendants headed by HSBC, the London-based financial giant with hedge fund clients that fed piles of cash into the enormous fraud.

According to the complaint, a hedge fund official dealing with HSBC once attributed Mr. Madoff’s stellar performance, which later turned out to be purely fictional and to a “magic formula” that no one else could replicate.

The lawsuit is the third multibillion-dollar complaint the Madoff trustee, Irving H. Picard, has filed against major financial institutions in the last two weeks. It almost certainly will not be the last.

Under Federal Bankruptcy law, the trustee must file all his recovery claims within two years of the initial bankruptcy filing. That did not occur until Dec. 15, 2008, but the bankruptcy court has defined the filing date as Dec. 11, 2008, the day of Mr. Madoff’s arrest.

That gives Mr. Picard until midnight on Saturday either to sue to recover cash withdrawn from Madoff accounts before the Ponzi scheme collapsed or to seek punitive damages from anyone involved in those withdrawals.

The large banks the trustee has sued — the Swiss-based UBS, JPMorgan Chase in New York, and now HSBC in London — were not alone in providing services or marketing products related to the Madoff fraud. For example, several other global banks sold investment vehicles that tracked Mr. Madoff’s performance, and some smaller banks provided services to “feeder funds” that channeled investments into Mr. Madoff’s funds.

It is unclear how many of those other entities may be in Mr. Picard’s sights. With the deadline approaching, Mr. Picard said in a recent report to the bankruptcy court that he “anticipates that he will file extensive additional litigation in the coming weeks.” Some complaints may be filed in foreign jurisdictions. The trustee has law firms working for him in Europe, Gibraltar, Canada, Bermuda and the Caribbean to help untangle connections between Mr. Madoff and “foreign individuals, feeder funds and international banking institutions,” he said in the court filing.

The latest lawsuit contends that the Madoff’s fraud “could not have been accomplished or perpetuated unless the HSBC defendants agreed to look the other way and to pretend that they were ensuring the existence of assets and trades when, in fact, they did no such thing.”

It asserts that HSBC and a dozen of its subsidiaries “aided, enabled and sustained” Mr. Madoff’s fraud in two important ways: by lending the bank’s prestige and performing services for hedge funds that raised money for Mr. Madoff; and by developing complex derivative products that provided additional sources of cash for the Ponzi scheme.

A dozen hedge funds, nearly two dozen European money-management businesses and 13 individuals were included as defendants in the 170-page complaint.

Among them were Sonja Kohn, the prominent Viennese financier who had ties to some of the largest Madoff feeder funds, and UniCredit, the Italian holding company whose Bank Austria unit was a partner with Ms. Kohn in her flagship company, Bank Medici.

Representatives of the defendants in Europe could not be reached for comment Sunday evening.

But in vigorous defenses against similar lawsuits filed by investors, lawyers for the HSBC units, the UniCredit subsidiaries and the Bank Medici defendants have all consistently denied that their clients had any knowledge of the Madoff fraud or were responsible in any way for not detecting it before its collapse.

To outsider investors, the “labyrinth” created by the hedge funds, managers and HSBC subsidiaries named as defendants looked like “a formidable system of checks and balances,” said Oren J. Warshavsky, a partner at Baker & Hostetler, the trustee’s law firm. “Yet the purpose of this complex architecture was just the opposite,” he said, “to avoid scrutiny and generate more fees.”

The trustee’s HSBC claim, filed electronically in United States District Court in Manhattan, is the largest, surpassing a $7.2 billion demand filed against the estate of Jeffry Picower, a longtime Madoff investor who died last year.

By the end of September, Mr. Picard had filed 19 lawsuits seeking to recover a total of $15.5 billion from members of Mr. Madoff’s immediate family, longtime individual investors such as Mr. Picower, and major feeder funds, including those operated by the Fairfield Greenwich Group and J. Ezra Merkin, a prominent Wall Street investment manager.

Mr. Picard’s recent lawsuits against JPMorgan, UBS and HSBC have added $17.4 billion to the amount he is claiming on behalf of victims, for a total of more than $32 billion.

That amount, which includes demands for punitive damages, is 50 percent more than the $20 billion he has estimated as the actual cash losses in the fraud, but he is not assured of recovering all the money he is seeking.

JPMorgan, UBS and HSBC have already vowed that they will fight the trustee’s claims in court and those battles could take years.

The total shown on investor account statements on the eve of the fraud’s collapse was nearly $65 billion, the sum of fictional paper profits that had accumulated in some accounts for decades. Mr. Picard has recovered approximately $1.5 billion through asset sales and out-of-court settlements.

Mr. Madoff is serving 150 years in prison after pleading guilty to orchestrating the fraud

WANTED SA thanks to all the staff at the Associated Press, and all the Parties, Press, Journalists, Law Enforcement and Securities forces who have contributed to this article and their sincere opinions and statements.

WANTED SA states that the facts and opinions stated in this article are those of the author and not those of WANTED SA. We do not warrant the accuracy of any of the facts and opinions stated in this article nor do we endorse them or accept any form of responsibility for the articles.