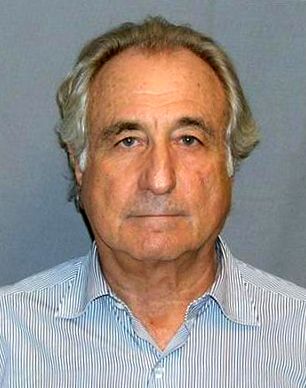

UBS BANK OF SWITZERLAND IMPLICATION WITH BERNARD MADOFF  PONZI SCAM >

PONZI SCAM >

FROM THE -

JOURNALS of Monte Friesner >

Financial Crime Consultant for WANTED SA >

Wednesday November 24, 2010 >

WANTED SA has confirmed today that Mr. Irving Picard who is acting as Trustee for Bernard Madoff's victims filed the massive lawsuit in the amount of $2 Billion USD against UBS and various associates at a US bankruptcy court.

UBS of Switzerland, which has made no comment on the charges; earned fees for promoting and administering Bernard Madoff's funds. UBS does not stop being involved in various frauds and recently UBS was the focus of assisting and coaching US Citizens to defraud the IRS of Tax Monies.

Madoff was sentenced to 150 years in prison for the scheme exposed in 2008.

The fraudster claimed high and stable returns for his investment fund over many years, attracting large investments from wealthy individuals.

In reality, the fund was worth only a fraction of what he claimed, and Madoff relied on "feeder funds" - such as those managed by UBS - in order to attract new investor money that could then be used to pay out the bogus return to existing investors.

'Aura of legitimacy'

"Madoff's scheme could not have been accomplished unless UBS had agreed not only to look the other way, but also to pretend that they were truly ensuring the existence of assets and trades when in fact they were not and never did," said David Sheehan; a lawyer acting on behalf of the trustee, Mr Picard.

This is not the first time that UBS has been accused of fraud, as was demonstrated by Bradley Birkenfeld who blew the whistle on UBS several years ago in another fraud.

The lawsuit claims UBS and its co-defendents made approximately $80m in fees over several years from their work with Bernard Madoff.

UBS "chose to enable Madoff's fraud for their own gain", claimed the trustee, and the bank's involvement gave the fraudster "an aura of legitimacy".

The Swiss bank is not alone in being accused of complicity in the fraud.

Mr Picard has filed at least 19 other lawsuits against other feeder funds, and is seeking to recover $17.5bn in total, including the money claimed from UBS.

WANTED SA thanks to the Associated Press who contributed to this report and all the Parties, Press, Law Enforcement and Securities forces who have contributed to this article and their sincere opinions and statements.

WANTED SA states that the facts and opinions stated in this article are those of the author and not those of WANTED SA. We do not warrant the accuracy of any of the facts and opinions stated in this article nor do we endorse them or accept any form of responsibility for the articles.